Exploring Options: Can Former Bankrupts Secure Credit History Cards Adhering To Discharge?

One usual question that occurs is whether former bankrupts can effectively acquire debt cards after their discharge. The solution to this questions entails a complex expedition of different aspects, from debt card alternatives customized to this market to the effect of past economic decisions on future credit reliability.

Understanding Bank Card Options

When thinking about credit rating cards post-bankruptcy, people must very carefully evaluate their demands and monetary situation to choose the most ideal choice. Guaranteed credit history cards, for circumstances, require a money down payment as collateral, making them a feasible selection for those looking to rebuild their credit report background.

Furthermore, individuals ought to pay close attention to the annual portion rate (APR), elegance period, annual charges, and benefits programs offered by different credit rating cards. By comprehensively examining these factors, people can make enlightened decisions when selecting a credit rating card that aligns with their monetary objectives and circumstances.

Variables Influencing Approval

When using for credit scores cards post-bankruptcy, comprehending the aspects that affect authorization is necessary for people looking for to reconstruct their monetary standing. Complying with a bankruptcy, credit rating scores often take a hit, making it more difficult to qualify for conventional credit report cards. Showing accountable financial behavior post-bankruptcy, such as paying bills on time and maintaining debt application reduced, can likewise positively affect credit report card approval.

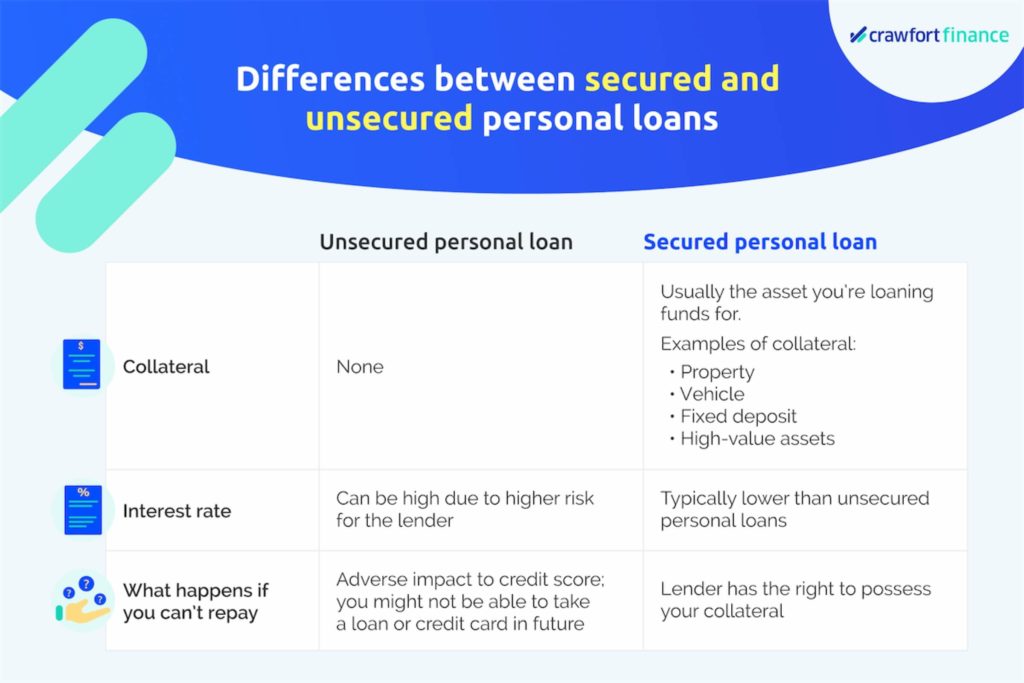

Secured Vs. Unsecured Cards

Safe credit rating cards need a cash money deposit as collateral, normally equivalent to the credit scores limitation expanded by the issuer. These cards usually supply higher credit history restrictions and reduced interest rates for individuals with great debt scores. Eventually, the selection in between protected and unprotected debt cards depends on the individual's financial situation and credit report objectives.

Structure Credit Report Sensibly

To successfully restore debt post-bankruptcy, establishing a pattern of accountable credit rating utilization is important. One key means to do this is by making timely settlements on all credit report accounts. Settlement background is a substantial aspect in establishing credit report ratings, so making certain that all costs are paid on time can gradually improve creditworthiness. Furthermore, keeping credit score card equilibriums reduced about the credit line can positively impact credit history. secured credit card singapore. Professionals suggest keeping credit history usage below 30% to demonstrate responsible credit rating management.

Another approach for developing credit history responsibly is to check credit score reports regularly. By assessing credit score reports for mistakes or signs of identification theft, people can deal with concerns quickly and keep the accuracy of their credit rating. Moreover, it is suggested to refrain from opening up multiple brand-new accounts at once, as this can indicate economic instability to prospective lending institutions. Instead, emphasis on gradually branching out charge account and demonstrating constant, liable credit scores actions over time. By adhering Visit Website to these practices, individuals can slowly restore their credit scores post-bankruptcy and job in the direction of a healthier monetary future.

Gaining Long-Term Conveniences

Having established a foundation of accountable credit score administration post-bankruptcy, individuals can now concentrate on leveraging their improved credit reliability for lasting monetary benefits. By consistently making on-time payments, maintaining debt use low, and monitoring their credit records for accuracy, former bankrupts can progressively reconstruct their credit rating. As their credit rating ratings enhance, they may end up being eligible for far better bank card provides with reduced rate of interest and higher credit history limitations.

Gaining long-term benefits from enhanced creditworthiness prolongs past just credit history cards. In addition, a favorable credit scores profile can improve work leads, as some employers may inspect credit score records as part of the hiring process.

Verdict

In verdict, former insolvent people might have difficulty safeguarding bank card adhering to discharge, but there are options offered to aid rebuild credit history. Recognizing the various types of charge card, variables impacting approval, and the significance of accountable debt card usage can help individuals click this site in this situation. By selecting the ideal card and utilizing it properly, previous bankrupts can progressively boost their credit history and reap the long-lasting benefits of having access to credit report.

Showing accountable monetary habits post-bankruptcy, such as paying expenses on time and keeping credit history use low, can likewise positively influence credit rating card approval. Additionally, maintaining debt card equilibriums reduced family member to the credit report limitation can positively impact credit ratings. By constantly making on-time repayments, keeping credit rating application reduced, and monitoring their credit scores reports for precision, former bankrupts can gradually restore their credit score scores. As their credit report scores raise, they may become qualified for better credit card supplies with reduced interest prices and higher credit rating limits.

Comprehending the different kinds of credit history cards, factors Website influencing approval, and the relevance of accountable credit rating card use can help people in this situation. secured credit card singapore.

Comments on “Specialist Tips on Obtaining Accepted for a Secured Credit Card Singapore”